"You can choose the training that suits your career development needs among very practical courses delivered by senior practitioners who know what is expected from young professionals to succeed in today’s financial markets. Modules can similarly be leveraged by companies looking for practical, cutting edge, training for their young professionals as part of their talent development programs.”

Pierre Francotte Academic Director

✔️The Advanced Master in Financial Markets consists of 20 courses, and you can design your own module by selecting as many courses as you wish among the curriculum of this Master.

✔️The courses give participants a much deeper and more practical understanding of financial markets than the ones offered by classical academic programmes and many external training programmes for young and mid-career professionals.

✔️ Module participants follow the courses together with the participants of the Advanced Master and benefit from the same teaching support. They may take exams at the end of the course like the Advanced Master participants.

✔️ Classes are taught after business hours (6 to 9 pm on weekdays or Saturdays) making it possible to combine them with a full-time professional activity.

✔️ Companies may register different staff to different courses if they wish as part of a single Module.

Get a quick check of eligibility by the team and get more info about the modules

By the end of your Module, you will be able to:

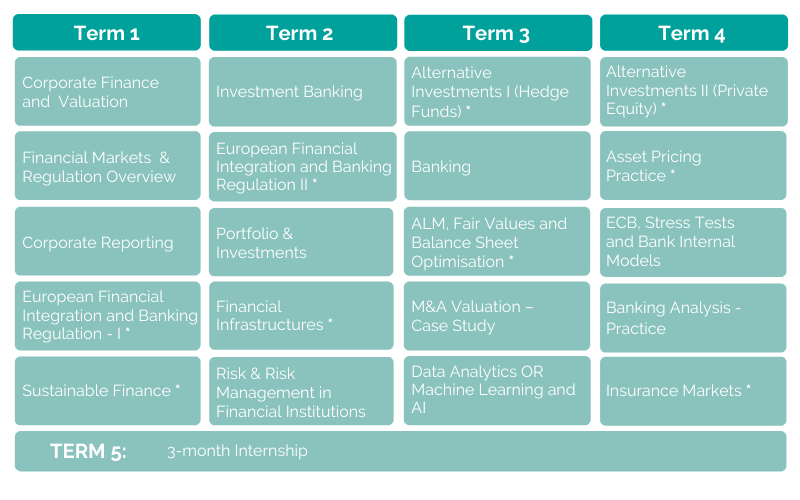

The curriculum of the Advanced Master covers the full range of financial activities, from banking and investment banking to asset and wealth management, private equity and hedge funds, and approach these activities from different angles: financial techniques, regulatory, risk management.

See the outline & structure of each course by clicking here.

The programme is designed for young or mid-career professionals who want to combine a full-time professional activity with a short-term, in-depth and practical training in specific areas as a means of bolstering their career and exploiting their full potential. Different courses can cater to the needs of different professional profiles, such as valuation experts and risk managers to lawyers or public affairs officers.

Modules of course are available for:

Courses are given by an unparalleled cast of senior practitioners and regulators and of highly respected academics.

In which other program can you get practical teaching by senior practitioners, including CEOs, CFOs, Chief Risk Officers, Head of Private Banking, Director at the European Commission, and other senior executives from banks, asset managers, hedge funds, private equity, infrastructures and regulators?

For the corporate fee schedule, please contact us at anna.vitiello@solvay.edu