Programme overview

The Module programme is a unique opportunity for young professionals seeking to strengthen their understanding and knowledge in quantitative finance to register for courses of the Advanced Master in Quantitative Finance to cater for your specific training objectives.

It is designed for young professionals who want to combine a full-time professional activity with a short-term, in-depth and practical training in specific areas as a means of bolstering their career and exploit their full potential.

The courses focus on applying quantitative finance knowledge to real-world problems and are given by highly respected academics and hands-on practitioners.

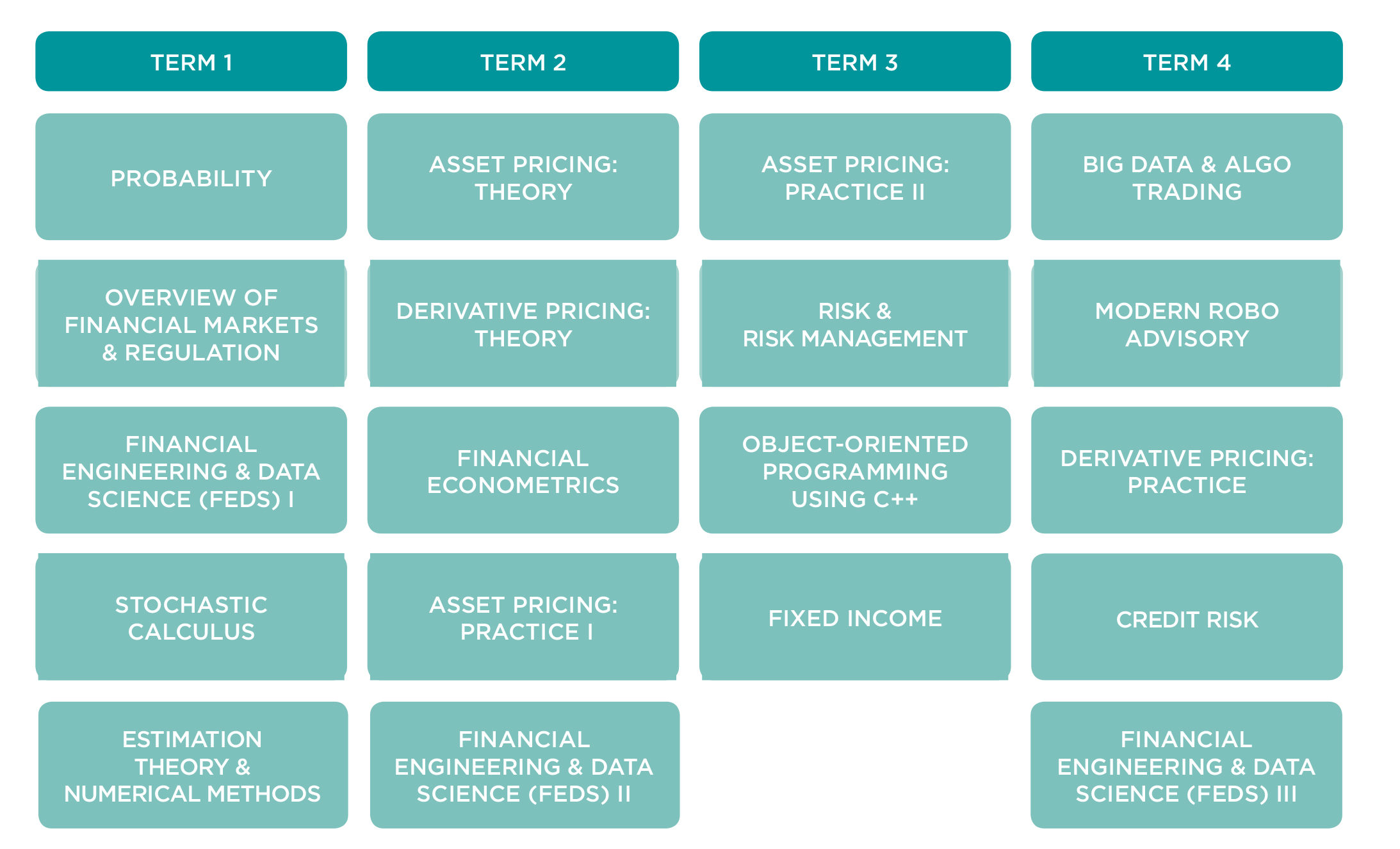

The Advanced Master in Quantitative Finance offers a unique set of quantitative tools in finance. Through a well-selected set of courses in Mathematics, Statistics / Econometrics, Finance, and Programming you will gain the all the necessary skills to become successful in your area of expertise whether this is Derivatives Analysis, Quantitative Asset Management or Quantitative Risk Management.

The Advanced Master in Quantitative Finance consists of 16 courses, and Modules can include between 2 and 4 courses among those. You may select a thematic module, such as a the Derivatives Specialist module, Quantitative Risk Management, Quantitative Asset Management module, or construct your own Customised module.

Participants may also take more than one Module per year or successive years.

Objectives

The main objective is to train a new generation of quantitatively skilled financial professionals. You will gain cutting-edge knowledge in quantitative finance and learn to apply it to real-life problems. You will not only be exposed to some of the latest and most used techniques and models, but also understand their advantages and limitations.

Depending on your module of choice you will be able to:

- build asset management strategies

- construct robust asset portfolios

- evaluate portfolio risk quantitatively and qualitatively

- efficiently extract data from massive databases

- understand the valuation aspects of counterparty risk

- value and understand the trading of complex derivatives

Candidates may apply on their own initiative or be sponsored by their employer seeking top-quality external training as a means of developing the effectiveness and the potential of their talented professionals.

Typically, the candidate’s background will be:

- Young professional in the first phase of his/her career in the financial sector or keen to direct his/her career towards the financial sector

- Sufficient academic background (generally master degree or equivalent diploma in a quantitative field or financial)

- The candidate’s academic background may be in finance, mathematics, physics or engineering.

- Some courses require a sufficient background in finance. Candidates who do not yet of such a background must include the course of Principles of Finance in the Module (contact us for details).

- Intellectual curiosity and discipline that are necessary to succeed in a very demanding environment

- Young professionals may also apply to register for modules of 2-4 courses instead of the whole programme. Contact us for details.

Proficiency in English necessary.

A Fact Sheet for each course, including the outline and the structure of the course, as well as a short biography of the professor is accessible here:

You are able to construct your Module according to your needs and preferences. If you wish to focus on specific themes, several modules can be designed:

- The Derivatives Analyst Module offers a choice between the several courses covering different facets of derivatives pricing and hedging. The main relevant courses are: The underlying theory of derivatives pricing, the practice of derivatives portfolio management and field courses in Fixed Income, Credit Risk and Structured Products.

– Derivative Pricing Theory

– Derivative Pricing Practice

– Fixed Income

– Credit Risk / Product Structuring

- The Quantitative Asset Management Module includes up to five courses that focus on the key types of quantitative asset management: The underlying theory of asset pricing, applying asset pricing in practice with portfolio construction tools, the econometric techniques to evaluate asset pricing models and Structured Products based on portfolio solutions.

– Asset Pricing Theory

– Asset Pricing Practice I & II

– Financial Econometrics

– Estimation Theory / Product Structuring

- The Quantitative Risk Management Module includes four courses that focus on the key types of quantitative risk management: The underlying theory of derivatives pricing, the practice of risk management, econometric techniques needed for risk management and field courses in Fixed Income, Credit Risk and Structured Products.

– Derivative Pricing Theory

– Financial Econometrics

– Fixed Income

– Risk and Risk Management / Credit Risk / Product Structuring

- Customised Modules can be constructed if you so wish, focusing for instance on risk and financial regulation, on asset valuation, or on the broader framework within which financial institutions operate. Check out the full list of courses of the Advanced Master à link to course description

Some courses anticipate a sufficient background in finance and/or economics, which can be obtained, for instance, through the courses of Principle of Finance and Principles of Economics. This is reviewed with you in the context of your registration to ensure that you can draw maximum benefit from the courses.

Participants may also take more than one Module per year or in successive years. For the expected schedule of courses for 2016-17, see “Admissions”

The programme faculty includes:

- Andrew Threadgold

- Céline Vaessen

- Pierre Francotte

- Davy Paindaveine

- Juan Carlos Rodriguez

- Jeroen Kerkhof

- Olivier Scaillet

- Karim Marrakchi

- Thomas Alderweireld

- Wim Van Hyfte

- Siegfried Hörmann

Jeroen Kerkhof,

Academic Director of the Advanced Master in Quantitative Finance

Practical information

Registration

If you wish to register for a Module during the period September-May 2018-2019, please follow the four main steps of our admission procedure:

1- Complete and submit the online pre-enrolment form together with your CV.

2- Receive feedback on your eligibility from the Academic Director.

3- Have a personal interview with the Academic Director.

4- Receive feedback on your admission. If positive, please note that you will have two weeks to finalise your registration by:

– Completing, signing and sending back the admission documents

– Paying the tuition

Application Deadline

The application deadline depends on the Module you select. If the first course of your Module is in:

- Term 1, the deadline is September 3, 2018

- Term 2, the deadline is early October 2018

- Term 3, the deadline is mid-January 2019

- Term 4, the deadline is late March 2019

For the schedule of Terms, see Schedule tab.

Certificate

Module participants attend classes and take up exams together with Participants in the Advanced Master in Quantitative Finance.

Upon completion of the Module, Participants will be awarded by the Solvay Brussels School of Economics and Management a certificate of participation to the relevant courses and exams.

Practical details

- Starting date: September 2018

- Location: Brussels

- Format: Afternoon (generally 2-9pm) or Saturday classes

- Language: English

- Length: For each 24-hour course: 8 classes of 3 hours over a period of 6 weeks (plus exam in following two weeks).

- Tuition:

- Module of 2 courses: €3,500

- Module of 3 courses: €5,000

- Module of 4 courses: €6,000

- Module of 5 or more courses: €1,000 per complementary course (special arrangements available for companies – contact us for details)

Practical information

Starting date: September 2018

Deadline to apply:

Term 1, the deadline is September 3, 2018

Term 2, the deadline is early October, 2018

Term 3, the deadline is mid-January, 2019

Term 4, the deadline is late March, 2019- Location: Brussels

- Format: Afternoon (generally 2-9pm) or Saturday classes

- Language: English

Tuition:

Module of 2 courses: €3,500

Module of 3 courses: €5,000

Module of 4 courses: €6,000

Module of 5 or more courses: €1,000 per complementary course (special arrangements available for companies – contact us for details)

Upcoming events

Keep me posted